do you pay capital gains tax in florida

Capital Gains Tax Any profits made on the sale of a property need to be included in your assessable income in the financial year that you sell it. When a seller sells a business in Orlando or any other area Capital Gains taxes are applied to the actual profit made upon the sale of the business and not the equity that was put in to the.

Capital Gains Taxes Are Going Up Tax Policy Center

You have lived in the home as your.

. This tax is called Capital Gains tax. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home. The following states do not tax capital gains.

Residents living in the state of Florida though there are those. Do you pay capital gains tax on a mobile home. They are Washington Nevada Texas Wyoming South Dakota Tennessee Florida Alaska and New Hampshire.

Florida does not have state or local capital gains taxes. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. In the province of Ontario the highest marginal rate is 5353 that bracket is reached for incomes in excess of 220000.

Generally speaking capital gains taxes are around 15 percent for US. Capital gains taxes are progressive similar to income taxes. Those that claim more than this much but less than 459751 are in.

Generally speaking capital gains taxes are around 15 percent for US. Florida Cap Gains Tax. This is because many of these states do.

If its been more than one year the gain is considered a long-term capital gain and taxed at a lower rate. How much tax do you pay when you sell a house in florida. Gains from the sale of stocks mutual funds and most other capital assets that you held for more than one year which are considered long-term capital gains are taxed at either a 0 15 or.

Residents living in the state of Florida though there are those who can see a long-term capital gains tax. Typically you dont need to pay CGT if. Whats left is considered your capital gain or your profit.

Federal Cap Gains Tax vs. There are only nine states without capital gains taxes. Individuals and families must pay the following capital gains taxes.

That means you wont have to pay any Florida capital gains taxes. In other words the entire capital gain the income recognized. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

Federal-level capital gains tax Despite the absence of capital gains tax required by the state Floridians are still subject to federal taxes. What taxes do you pay when you sell a house in Florida. What is capital gains on real estate in Florida.

Capital Gains Tax Rate. The capital gains tax is calculated on the profit made from the real estate sale minus expenses and the applicable capital gains tax will. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

Single filers that make up to 41675 in 2022 are completely exempt. Do You Pay Capital Gains Tax In Florida. For homeowners who have owned and lived in a home for at least two.

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. The rate depends on your income level. However you will still owe federal capital gains tax on.

The amount of taxes youre responsible. Any gain in the sale of the mobile home would be reported on your federal income tax return for the year of the sale.

Tax Tips For Selling Your Florida House

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Short Term And Long Term Capital Gains Tax Rates By Income

Do You Pay Capital Gains Taxes On Property You Inherit

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gains Tax Calculator Estimate What You Ll Owe

Tax Implications Of The Florida Lady Bird Deed Ptm Trust And Estate Law

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Ask An Expert Ny Capital Gains Tax If I Live In Florida Amnewyork

2020 2021 Capital Gains Tax Rates And How To Calculate Your Bill

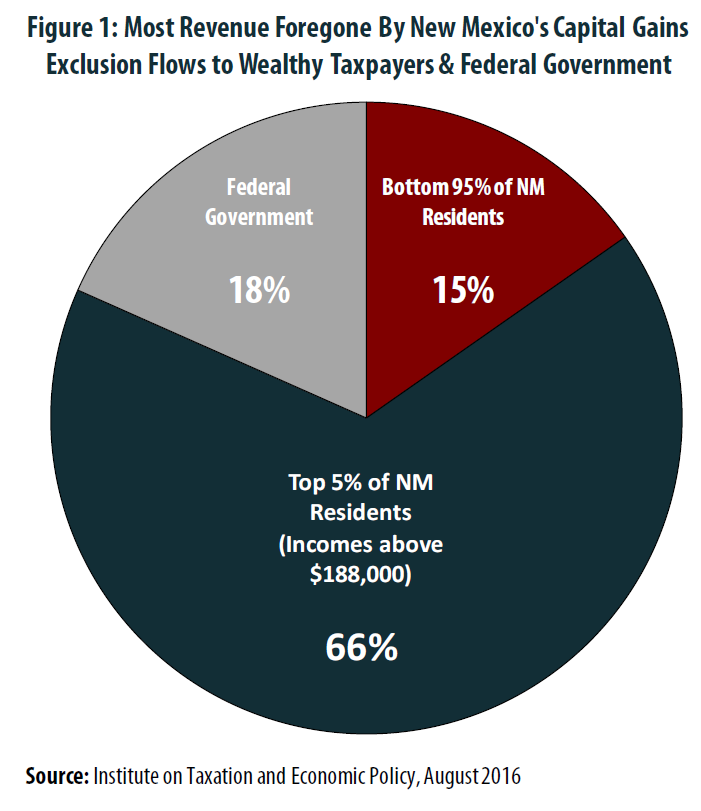

The Folly Of State Capital Gains Tax Cuts Itep

Crypto Capital Gains And Tax Rates 2022

Taxes On Stocks How Do They Work Forbes Advisor

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool